tax deferred exchange definition

A tax-deferred exchange is also called a 1031 tax-deferred exchange and 1031 is a section of the Internal Revenue Service that identifies investment property. This sort of 1031 exchange is meant to allow buyers to purchase new properties now while hanging onto real estate they want to sell until later when it might be worth more.

1031 Exchange Explained What Is A 1031 Exchange

But in todays world like I said a Starker exchange is just the everyday 1031 tax deferred-exchange.

. Well they should use it any time theyre selling an investment property theyve got a gain on. A tax-deferred exchange is a method by which a property owner trades one or more relinquished properties for one or more replacement properties of like-kind while deferring the payment of federal income taxes and some state taxes on the transaction. Definition of tax-deferred US.

Define Reverse Tax-Deferred Exchange. The 1031 tax-deferred exchange is a method of temporarily avoiding capital gains taxes on the sale of an investment or business property. Going by the IRC description of section 721 c a US.

A section 721 c partnership is a partnership in which the US. The 1031 exchange is in effect a tax deferral methodology whereby an investor sells one or several relinquished properties for one or more like-kind replacement properties and defers the tax. The same principle holds true for tax-deferred exchanges or real estate investments.

1 This property exchange takes its name from Section 1031 of the Internal Revenue Code. Section 1031 properties are properties that businesses or investors exchange to defer paying taxes on any profit gained from their sale. The exchange allows for the deference of any taxable gains on the.

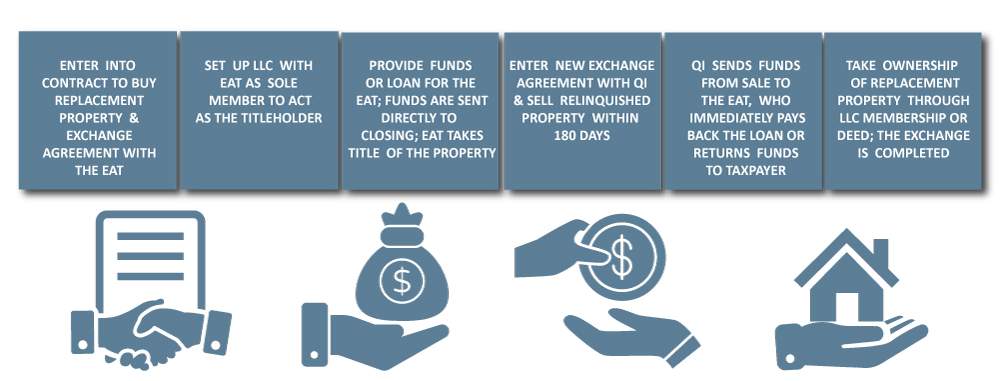

The Reverse Exchange is the opposite of the Delayed Exchange. When do your clients normally use a Starker exchange. 1031 Tax Deferred Exchanges allow you to keep 100 of your money equity working for you instead of paying losing about one-third 13 of your gain or profit toward the payment of your capital gain and depreciation recapture taxes.

A tax-deferred exchange in which one asset is exchanged for a similar asset of the same nature character or class. Section 1031 is a provision of the Internal Revenue Code IRC that allows a business or the owners of investment property to defer federal taxes on some exchanges of real estate. A 1031 Exchange is an exchange of like-kind properties that are held for business or investment purposes in the United States.

The termwhich gets its name from Internal Revenue Code IRC. In real estate a 1031 exchange is a swap of one investment property for another that allows capital gains taxes to be deferred. However its not as simple as an individual taxpayer buying.

If you believe a reverse exchange could be right for you give us a call. Taxpayer will realize gain when that taxpayer contributes section 721 c property to a section 721 c partnership. Tax-deferred status refers to investment earningssuch as interest dividends or capital gainsthat accumulate tax-free until the investor takes constructive receipt of the profits.

Not taxed until sometime in the future a tax-deferred savings plan Learn More About tax-deferred Share tax-deferred Dictionary Entries Near tax-deferred tax. EXCHANGE ACCOMODATION FEE When an escrow transaction involves a 1031 Tax Deferred Exchangeor a simultaneous exchange of property there shall be an additional charge of 100. Those taxes could run as high as 15 to 30 when state and federal taxes are combined.

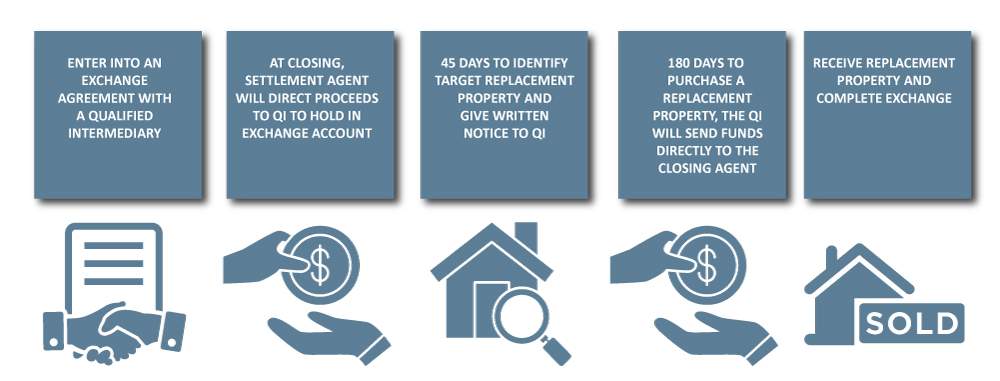

A delayed exchange for practical purposes. Like-kind property When two properties belong to the same category or type theyre called like-kind. The exchange aspect of it is if you exchange one piece of property of equal or greater value than the value of the property that you have you dont have to recognize any gain.

The principle underlying these tax-deferred exchanges is that by using the exchange value in one property to buy anotherinstead of receiving cash for that exchange valuea property owner is simply continuing the investment in the original property. When someone sells assets in tax-deferred retirement plans the capital gains that would otherwise be taxable are deferred until the holder begins to cash out of the retirement plan. The tax deferred exchange as defined in 1031 of the Internal Revenue Code offers taxpayers one of the last great opportunities to build wealth and save taxes.

By completing an exchange the Taxpayer Exchanger can dispose of investment or business-use assets acquire Replacement Property and defer the tax that would ordinarily be due upon. Taxpayer and one or more related foreign persons own 50 or more of the partnership interests. A 1031 exchange is similar to a traditional IRA or 401k retirement plan.

Like-kind property can have a broad interpretation. In a tax-deferred exchange under Internal Revenue Code Section 1031 the sellertaxpayer is prohibited from receiving the proceeds from the sale of the relinquished property. Handling earnest money deposits in a 1031 Exchange The company also offers strategic advisory asset management tax-deferred exchange and capital markets solutions.

Is a reverse tax-deferred like-kind exchange pursuant to section 1031 of the Internal Revenue Code of 1986 as amended and Revenue Procedure 2000 - Section 1031 promulgated thereunder.

1031 Exchange Explained What Is A 1031 Exchange

The Basics On 1031 Simultaneous Tax Deferred Exchanges 1031 Exchange Place

1031 Exchange How You Can Avoid Or Offset Capital Gains

Can You Do A 1031 Exchange Into Reit All Section 721 Rules

Like Kind Exchanges Are Now Clearer Journal Of Accountancy

Guide To 1031 Exchanges 1031 Crowdfunding

Irc 1031 Exchange 2021 Https Www Serightesc Com

What Is A 1031 Exchange Dst How Does It Work And What Are The Rules

What Is A 1031 Exchange Asset Preservation Inc

Are You Eligible For A 1031 Exchange

Are Tax Deferred Exchanges Of Real Estate Approved By The Irs Accruit

1031 Exchange When Selling A Business

1031 Exchange What Is It And How Does It Work Plum Lending

What Is A 1031 Exchange Properties Paradise Blog

1031 Exchange What Is A 1031 Exchange Mark D Mchale Associates